YOUR FINANCIAL NEEDS ANALYSIS

We're big on the idea that financial security is determined more by desire and discipline than by social or economic background. We help our clients understand money – from how to acquire more of it, to making it work harder for them.

The Steps

INSPECT WHAT YOU EXPECT

INCREASE CASH FLOW

ELIMINATE DEBT

DEVELOP AN EMERGENCY FUND

PROTECT WHAT YOU HAVE

BUILD LONG-TERM FINANCIAL INDEPENDENCE

ESTATE PLANNING

STEP ONE:

INSPECT WHAT YOU EXPECT

Track Earnings and Expenditures

Keeping a close eye on your financial portfolio means no surprises when it comes to how your money is doing.

Periodic “inspections” of your financial condition allow you to better manage your financial affairs. The power of the internet is now a valuable tool to monitor your personal finances online.

Investment Risk Disclaimer

1 Information contained herein should not be construed as legal or tax advice and is intended for illustrative purposes only. All charts, graphs, estimates and projections are based upon hypothetical situations, are not representative of any particular financial condition and are not intended to represent a likely or guaranteed return or outcome for any prospective customer.

The Afortus Financial Needs Analysis is based upon source information believed to be accurate. It is an analysis to determine appropriate individual financial needs and does not constitute a solicitation for the purchase or sale of any specific financial product or service.

STEP TWO:

INCREASE CASH FLOW

Manage Expenses

Money that you don’t spend is money in your pocket that can be applied toward debt reduction and wealth accumulation.

Below are important strategies that will allow you to increase and better manage what you have available to spend:

- Following a budget will help reduce monthly expenses. An important part of this process is to determine the difference between “needs” and “wants”.

- Review low-interest savings accounts (bank CDs,etc.) for opportunities to earn more or pay down high-interest debts.

- Learn to live on 90% or less of your income after taxes.

- Raise insurance deductibles to appropriate levels for additional savings.

- Cancel Credit Life Insurance on all financed items and credit card debt.

- Eliminate Private Mortgage Insurance (PMI) as soon as your equity reaches 20% of the value of your home.

- Earn tax benefits from a home-based business. • Check into qualified plan options.

Earn Additional Income

If possible, explore a second career option, or look for part-time work that can bring in additional income. Also, consult with a qualified tax advisor about adjusting your W-2 allowances if you normally get a tax refund. This will allow you to more quickly apply funds against your debt and toward your wealth accumulation.

Investment Risk Disclaimer

1 Information contained herein should not be construed as legal or tax advice and is intended for illustrative purposes only. All charts, graphs, estimates and projections are based upon hypothetical situations, are not representative of any particular financial condition and are not intended to represent a likely or guaranteed return or outcome for any prospective customer.

The Afortus Financial Needs Analysis is based upon source information believed to be accurate. It is an analysis to determine appropriate individual financial needs and does not constitute a solicitation for the purchase or sale of any specific financial product or service.

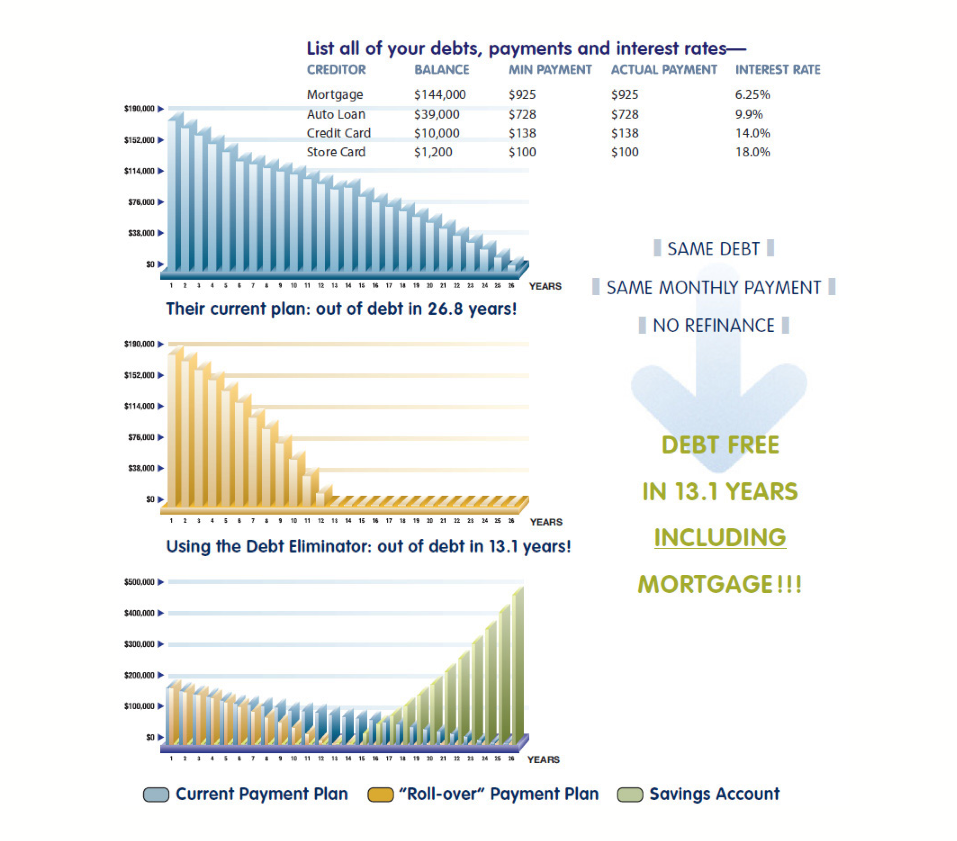

STEP THREE:

ELIMINATE DEBT

Investment Risk Disclaimer

10 Example is based on a hypothetical debt structure and is for illustrative purposes only. Individual family debt structures vary widely based upon various factors and financial scenarios (i.e.: interest rates, principal balances, hidden fees, and risks vary). The illustrated rate of 8% is hypothetical and not based on any actual investment or specific product. It does not reflect the risk, expenses, or charges connected with any particular investment—but is provided for illustrative purposes ONLY.

11 Example is based upon a hypothetical debt structure and is for illustrative purposes only. Individual family debt structures vary widely based upon various factors and financial scenarios (i.e.: interest rates, principal balances, hidden fees, and risks vary).

12 Example is based on hypothetical mortgage refinance and is for illustrative purposes only (i.e.: assumes estimated closing costs, interest rate and savings are realized and applied as indicated and debt level is not otherwise increased). Individual family debt refinancing will be subject to specific loan qualification requirements, availability and other applicable market terms and conditions.

13 The illustrated rate of 8% is hypothetical, and is not based on any actual investment or product. It does not reflect the risks, expenses, or charges connected with any particular investment but is for illustrative purposes only.

STEP FOUR:

DEVELOP AN EMERGENCY FUND

Have a Plan for Emergencies

An adequate emergency fund should:

- Be in a place that’s safe

- Return a better interest rate than a checking account

- Be completely liquid

- Be separate from your checking account and be funded systematically

Keep a “Stash of Cash”

As a general rule of thumb, you should keep a minimum of three months income or salary— preferably six months—where it can be readily accessed in case of emergency.

Investment Risk Disclaimer

Information contained herein should not be construed as legal or tax advice and is intended for illustrative purposes only. All charts, graphs, estimates and projections are based upon hypothetical situations, are not representative of any particular financial condition and are not intended to represent a likely or guaranteed return or outcome for any prospective customer.

The Afortus Financial Needs Analysis is based upon source information believed to be accurate. It is an analysis to determine appropriate individual financial needs and does not constitute a solicitation for the purchase or sale of any specific financial product or service.

Step Five: Investment Risk Disclaimer

1 Information contained herein should not be construed as legal or tax advice and is intended for illustrative purposes only. All charts, graphs, estimates and projections are based upon hypothetical situations, are not representative of any particular financial condition and are not intended to represent a likely or guaranteed return or outcome for any prospective customer.

The Afortus Financial Needs Analysis is based upon source information believed to be accurate. It is an analysis to determine appropriate individual financial needs and does not constitute a solicitation for the purchase or sale of any specific financial product or service.13 The illustrated rate of 8% is hypothetical, and is not based on any actual investment or product. It does not reflect the risks, expenses, or charges connected with any particular investment but is for illustrative purposes only.

STEP FIVE:

PROTECT WHAT YOU HAVE

Protect Against Loss of Income

During a person’s younger “income-earning” years, it is important to have adequate insurance to cover that income in case of unexpected death or disability.

Insure Family Assets

As a person nears retirement age and has built substantial assets for retirement, one’s financial plan should ideally transform from protecting income to protecting assets. This can be achieved by, among others, using insurance for tax and estate planning.

Investment Risk Disclaimer

1 Information contained herein should not be construed as legal or tax advice and is intended for illustrative purposes only. All charts, graphs, estimates and projections are based upon hypothetical situations, are not representative of any particular financial condition and are not intended to represent a likely or guaranteed return or outcome for any prospective customer.

The Afortus Financial Needs Analysis is based upon source information believed to be accurate. It is an analysis to determine appropriate individual financial needs and does not constitute a solicitation for the purchase or sale of any specific financial product or service.

The Afortus Financial Needs Analysis is based upon source information believed to be accurate. It is an analysis to determine appropriate individual financial needs and does not constitute a solicitation for the purchase or sale of any specific financial product or service.

STEP SIX:

BUILD LONG-TERM FINANCIAL INDEPENDENCE

Stay Ahead of Inflation

There is no real secret to staying ahead of inflation—your assets simply have to earn more interest than inflation takes away. There are numerous options available to help your assets outpace inflation. Your Afortus Associate will work with you to formulate a plan to help meet your individual needs and objectives.

Minimize Your Tax Burden

No one can escape death, and escaping taxes appears to be just as unlikely. Suggestions on ways to minimize the taxation of your assets are also available from your Afortus Associate. You should also consult qualified legal and tax advisors.

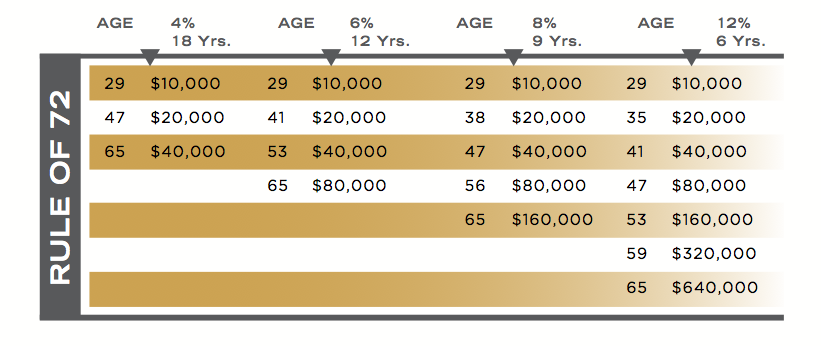

“The Rule of 72” 15 table will help you determine how long it will take to double your money based upon the interest rate your money earns. Just divide the number 72 by the interest rate. Illustrated in the chart below are several examples.

Taxes can take a big bite out of your ability to save and accumulate your money. It’s important to understand all the tax advantages available to you and apply them to minimize your tax liability. The chart below illustrates examples of how much money is needed on a monthly basis to reach the goal of a million dollars—in both a taxable and non-taxable scenario.

Compound Annual Return17

The chart below is an example of how much one dollar could have grown after being invested in various markets beginning in 1926. The rate of inflation during the same period is included for reference (in red). As with any charted investment history, these figures do not guarantee future returns of any financial products.

Investment Risk Disclaimer

15 The “Rule of 72′′ is a common mathematical formula that approximates the time period required to double a principal amount at a fixed rate of return. Actual rates vary over time and the rule of 72 numbers shown are for illustration purposes and should not be construed to infer the rate of return associated with any particular financial product.

16 The “Retirement Goal” chart assumes a total tax liability of 35% and shows a rate of return not based on any actual investment, but is for illustrative purposes only.

17 Note: This chart does not reflect the past or future performance of any particular financial product (Data 1926-2007) and is for illustrative purposes only. The data assumes the reinvestment of all income and does not consider account expenses such as transaction costs or taxation. The average return represents a compound annual return. Government bonds and Treasury bills are guaranteed by the full faith and credit of the United States government as to the timely payment of principal and interest. Bonds are typically intended to provide income and/or diversification. U.S. government bonds may be exempt from state taxes and income is taxed as ordinary income in the year received. With government bonds, the investor is a creditor of the government. Stocks are not guaranteed and are more volatile than the other asset classes. Large company stocks provide ownership in corporations that intend to provide growth and/or current income. Small company stocks provide ownership in corporations that intend to seek high levels of growth. Small company stocks are more volatile than large company stocks and are subject to significant price fluctuation, business risks, and are thinly traded. Capital gains and dividends received may be taxed in the year received. Underlying data is from the Stocks, Bonds, Bills and Inflation® (SBBOII®) Yearbook, by Roger G. Ibbotson and Rex Sinquefield updated annually. An investment cannot be made directly in an index. Also, past performance is never a guarantee of future results.

SOURCE: Small Company Stocks—represented by the fifth capitalization of quintile stocks on the NYSE for 1926-2007 and the performance of the Dimensional Fund Advisors, Inc (DFA) U.S. Micro Cap Portfolio thereafter; Large Company Stocks— Standard and Poor’s (S&P) 500®, which is an unmanaged group of securities and considered to be representative of the stock market in general; Government Bonds—20 year U.S. Government Bond; Treasury Bill; Inflation—Consumer Price Index.

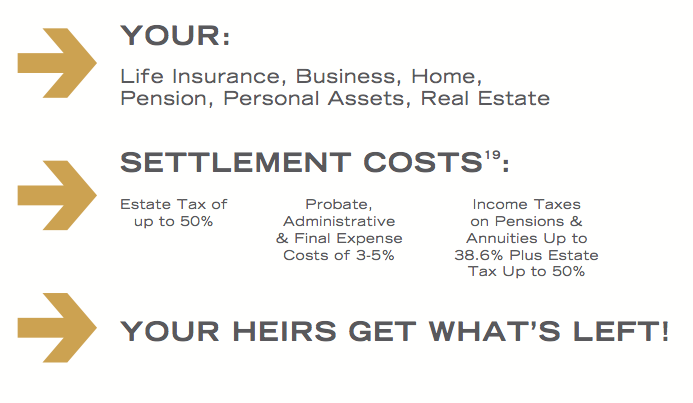

STEP SEVEN:

ESTATE PLANNING

Prepare an Adequate Estate Plan 18

When it comes to providing for your family’s future—not having an estate plan in place can prove very costly. A lifetime of hard work and savings can be decimated following your death if you don’t have a proper estate plan in place. By setting up an estate plan now, you’ll protect what you have, and enjoy the peace of mind of knowing your loved ones will be well cared for after you’re gone.

Afortus Financial is here to help you reach your financial goals. If you’ve been thinking about planning for the future, now is the time to start. Time is on your side—but only if you begin now!

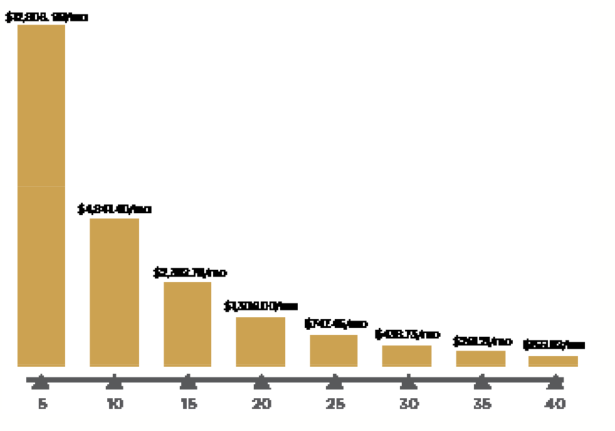

Years Until Retirement

This chart dramatically illustrates how much money must be put away monthly in order to reach a million dollars—depending on the amount of years until retirement. The sample figures assume an annual rate of return of 10% interest. 20

Investment Risk Disclaimer

1 Information contained herein should not be construed as legal or tax advice and is intended for illustrative purposes only. All charts, graphs, estimates and projections are based upon hypothetical situations, are not representative of any particular financial condition and are not intended to represent a likely or guaranteed return or outcome for any prospective customer.

The Afortus Financial Needs Analysis is based upon source information believed to be accurate. It is an analysis to determine appropriate individual financial needs and does not constitute a solicitation for the purchase or sale of any specific financial product or service.